Part 1 of a 2-part series for the sales teams

By: Katie Moro, Vice President, Data Partnerships, Hospitality, Amadeus

The individual business traveler has always been a source of demand for hotels. In fact, there is an entire RFP process, and sales deployment on and above property to pursue and ensure brands/management companies and individual hotels are receiving at least their fair share of the production from this segment. As with most things this year, the corporate travel landscape has changed. While airline and hotel demand has been impacted by a decline in corporate and group business, we think it’s vital for hoteliers to know that corporate travel still exists.

Recently there was a lot of attention around market performance through the end of summer. Labor Day saw an increase in bookings. It seemed as though remote working and learning would help fuel booking demand as leisure trips extended into the fall season. But leisure business is not the only available opportunity. Today we want to dive into the performance related to individual business travelers immediately following Labor Day and looking forward through the end of October.

Are businesses traveling?

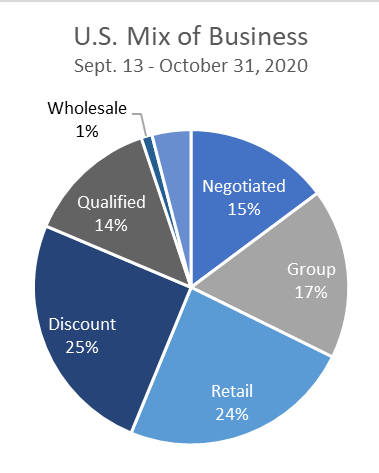

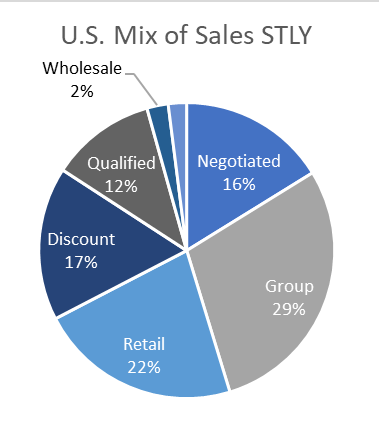

The on-the-books total occupancy in the US for the current and upcoming six weeks is 13.8%. While this is lower than last year’s performance, we must consider the changing dynamics of demand. Pre-pandemic, the individual business travelers associated with the negotiated market segment contributed approximately 16% of the total occupied rooms. Considering the forward-looking data in our Demand360® business intelligence solution, we show the current individual business travelers’ business in the negotiated segment is at a 15% contribution.

When we review these percentages, we must consider that the US hotels have just 35% of the rooms occupied compared to the same time last year, so percentages are from a smaller base of business in the current year. But when things are constantly shifting within our markets, it’s encouraging to see that with the right sales resources and data, we still can influence the performance of our hotels.

Who is traveling?

In April 2020, US markets saw a drop off in booked business. From that time through the current week, the business sector has been steadily working to move forward into month over month increased room nights. Peering deeper into the data, we see the healthcare, aerospace & defense, retail, and industrial sectors contributing the highest room night production during this time.

Where are they going?

Looking at the current and upcoming six weeks, we identified the top-performing markets for individual business travelers. These markets are not achieving the highest overall occupancies for this period but do represent the highest mix of negotiated room nights. For example, New York City currently has 8.3% of its total capacity committed, with 9.7% of that coming from the negotiated segment.

What can you do next?

People are still traveling for business. You need to understand who is traveling and where they’re booking. Review business intelligence booking data for your market and identify account activity in your CRM to target key accounts booking business. Reach out to these companies to let them know you have availability and outline your COVID-19 safety precautions. Take some time to share the latest regulations for your market to help them gain confidence that travel to the area can be done safely. Be sure also to consider the channels where these travelers may be booking as current trends are showing shifting booking patterns.

For more best practices on leveraging data to build an effective marketing strategy, please visit our Planning for Hospitality Recovery resource center

Please look for our October publication when we evaluate group business in 2021.

People are still traveling for business. You need to understand who it is and where they’re booking.