HSMAI partnered with ZS to conduct a sales enterprise incentive compensation benchmarking study in Q4 2021 and then refreshed this research in Q2 2022, featuring participation from several major hospitality brands. This study investigated top-of-mind emerging themes in above-property sales compensation and talent management across hospitality and other industries to highlight common challenges in sales culture, talent retention, pay compression and inflation.

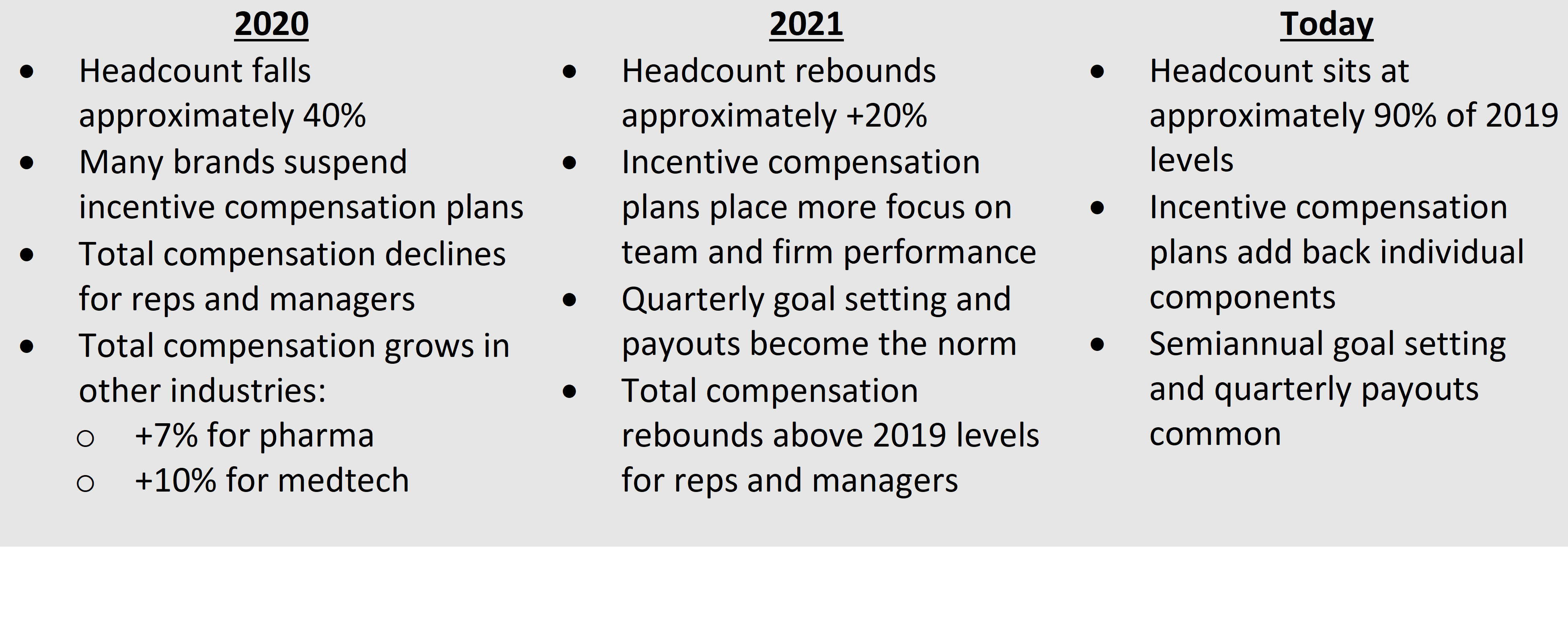

In 2020, many brands’ sales organizations and incentive compensation plans were upended, requiring challenging and swift decision-making. In 2022, we see brands adapting their organizations and plans to meet the “return-to-travel” moment. We have tracked some key year-over-year trends here:

- Difficulty forecasting and setting accurate goals for sellers, especially for an entire year

- Reinstating individual plan weighting to refocus incentive compensation on the factors under a rep’s control

- Frequent goal setting throughout the year, which requires more effort from limited sales support staff

- The priority to hire and retain flexible talent to adapt to uncertain business climate and segments

- The need to support team culture by retaining some team-based plan components

These challenges may be a temporary result of COVID-19-driven market dynamics, but the changes that brands made to adapt to the new environment may be here to stay in the long run. Hospitality is not alone in facing these challenges. Even in industries that were not as directly affected by the pandemic, we see that their sales teams and ways of working have evolved. Some universal themes across sales organizations we’ve observed include:

- Pay compression: ZS has consistently observed sales pay compression in hospitality and other industries over the past several years. Pay compression is a narrowing range of variable pay for reps, with fewer high and low outliers in pay and more sellers centered close to the mean. Initial hypotheses for pay compression include:

- Companies are becoming more risk averse and are avoiding high variation in variable pay, while also setting more accurate goals for sellers.

- Sellers are becoming more risk averse and want to know the range of take-home pay to expect with a higher degree of certainty.

- Sellers also have less marginal impact, thanks to support tools like sales playbooks, automated lead generation and next-best action engines to guide them.

- Companies have started to place floors to maintain talent and lower caps to protect themselves fiscally due to COVID-19.

- Efficiency and flexibility: Hospitality brands continue to find value in flexible, generalized seller roles. They also have shifted their focus to new customer segments and reduced seller headcounts as legacy segments reduced travel. But now that legacy segments are returning, brands are maintaining new segments that emerged during COVID-19, continuing to grow the seller team size and maintain generalist roles.

- Hiring trends and culture: As business stabilizes in 2022, brands continue to prioritize investing in talent. Flexible and adaptable sellers who can be redeployed across multiple customer segments (e.g., group or SMB) are sought after by hospitality brands, as team sizes look to return to 2019 levels by the end of 2022. Brands also have found investing in culture necessary for the sales organization’s health, leading them to focus on talent development, elevating team morale with contests and SPIFFs, and rewarding loyal, tenured sellers fiscally.

- Salary changes and inflation: As inflation continues, hospitality brands’ on-property cost increases have been largely passed to customers so far. There is concern, however, that inflation will continue to shape 2023 strategy as brands eventually grapple with ways to lower expenses to maintain their margins. While inflation impact has not been top-of-mind in sales incentive compensation yet, brands expect it to be a balancing act between retaining talent in the broader market and returning to profitable growth.

ZS and HSMAI frequently lead similar studies to help hospitality brands better navigate these uncertain times. If you are interested in participating in future research, please reach out to Bob Gilbert (bob.gilbert@hsmai.org) and Mike Francis (mike.francis@zs.com).