By Timothy R. Wiersma, CRME, Founder and Principal, Revenue Generation LLC, and a member of HSMAI’s Revenue Optimization Advisory Board

At this point, engaging with the recovery is like playing poker: You don’t know what cards you’re going to be dealt next. The delta variant is just the latest in a year and a half of unpredictable hands — but even before the pandemic, the hospitality industry was facing serious problems such as a chronic labor shortage. By forcing layoffs and furloughs that have pushed hospitality professionals into other industries, COVID has only exacerbated things.

Add to that the challenges of managing a post-COVID workforce — from attracting the next generation of talent with adequate wages, benefits, and telework options, to enforcing vaccine mandates and other health and safety measures — and you have a dilemma that is going to be with us for the foreseeable future. During a recent call for HSMAI’s Revenue Optimization Advisory Board (ROAB), I moderated a discussion during which ROAB members discussed how their companies are addressing labor shortages, not just today but in the years ahead. Here are key insights they offered during our conversation:

The end of amenities? “Addressing a labor shortage means cutting amenities. Some of the amenities, properties are not opening, and they’re also revisiting breakfast, which is tough because in a mid-scale and a limited-service property that is what travelers expect. So that’s one thing. And then also, housekeeping. I don’t see the labor shortage easing up in the fall, so I don’t believe we’ll see amenities like that coming back anytime in the near future.”

Sign-on bonuses and other incentives: “Using Las Vegas as one example, I’ve heard about things like $1,000 sign-on bonuses for housekeeping. Companies are getting pretty creative with trying to attract new people or even get back those team members that may have left during the pandemic with some major incentives that are fairly unprecedented.”

Wages and daily pay: “We have tried a number of different things like offering daycare and improved cafeteria lunches and different stipends and sign-on and retention bonuses, and we haven’t seen traction with much of anything other than wage increases — and trying to be really proactive about that before you’re at a point where you’re pulling rooms offline or closing outlets because you can’t service them. The other thing that’s been impactful has been moving to daily pay — instead of paying out every two weeks, at the hotel level you’re paying out each day. I know that there have been tests from various brands in a number of markets where they’re looking at kind of a gig work setup, where if you’re a housekeeper, you can opt in to work on a certain day and they might allocate you to whatever hotel in that market needs the help, and then you go work and you get paid that day.”

Immigration restrictions: “One of the things that I don’t hear enough talk about is the cumulative impact of restrictions on natural legal immigration — for seasonal markets, the availability of the HB1 and L1 visas. If we get those surges in labor supply seasonally that we’ve gotten used to or that we need in some destinations, that might alleviate, especially in some resort markets. There are a lot of international markets out there that are flush with highly skilled, very qualified workers that maybe had visas before and don’t have them now.”

Work from home: “We’re looking at flexible options and hybrid options. We’ve had to offer some full-time work at home just to get revenue talent, which has been incredibly hard to find, especially for our resort destinations. We’re seeing that as more of a normal thing in the future is okay: You can work remote, and we’ll fly you out to the resorts every so often.”

Rebuilding faith in hospitality: “The pandemic has created an environment where confidence is something that needs to be rebuilt for people. There are a lot of people who say, ‘Boy, is this the right industry to be in?’ In our area of revenue optimization and data, quite frankly, every company now is doing this kind of work in every vertical, and so people are looking for areas with more stability. I think we have to do a lot more to communicate with people a level of confidence in the future, and that this is a good industry to be in.”

Realistic goals: “We also need to think about our own people this year, and how we bonus them and incent them and measure them, because with people shutting down inventory, they can’t necessarily win on the STAR Report or hit their budgets. So, what are those new measurements, and how do we make sure that we’re incenting them and rewarding them and recognizing their successes if it’s not through the numbers and the data?”

Recruiting students: “I wonder if the message that comes to hospitality students from all of our organizations has to be finetuned a little bit. If you’re looking for people in revenue management but you’re sending out talent scouts that are very focused in operations, revenue management gets very little voice. As heads of revenue strategy, are we figuring out what is our voice when we go to all of these places to recruit?”

More positive messaging: “I was going to comment on messaging as well, but externally. If you’re thinking about entering the industry or you’re making a change, or you’re just an adult looking for a position and you think hotels could be good because you could grow — we have a PR problem, right? The news is still about how much hotels are struggling, so when people are evaluating a job at XYZ or a job at the front desk, they’re probably going to go for XYZ, just because it seems maybe more stable and not like an industry on the verge of collapse. Figuring out a way to reframe that message could be very important from a recruiting perspective.”

HSMAI recently honored the 2020

HSMAI recently honored the 2020

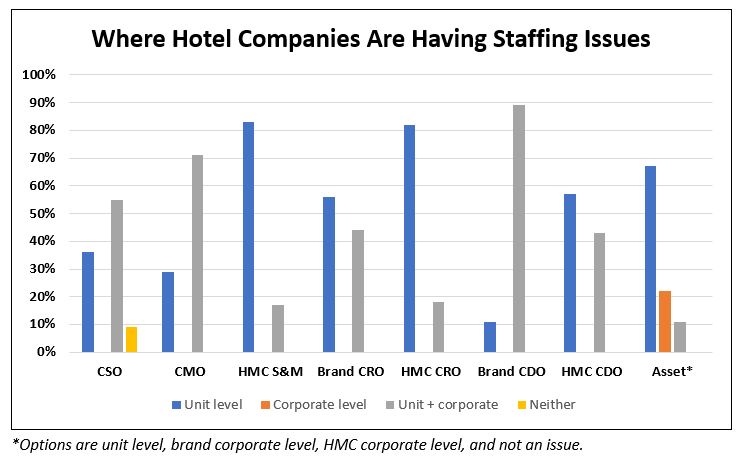

There’s no clear consensus among the answers we received, except that no one isn’t experiencing staffing issues at the unit level. Beyond that, the extent to which talent issues are being felt at the corporate level varies widely — although they deniably are being felt.

There’s no clear consensus among the answers we received, except that no one isn’t experiencing staffing issues at the unit level. Beyond that, the extent to which talent issues are being felt at the corporate level varies widely — although they deniably are being felt.

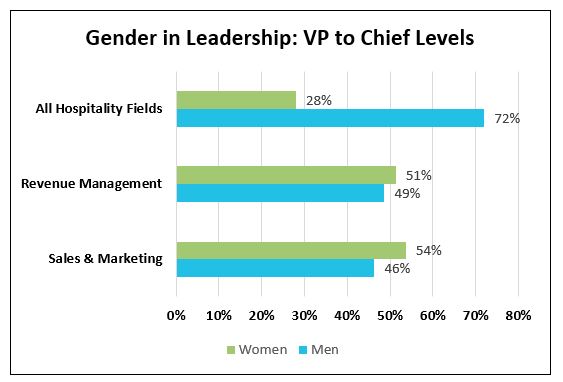

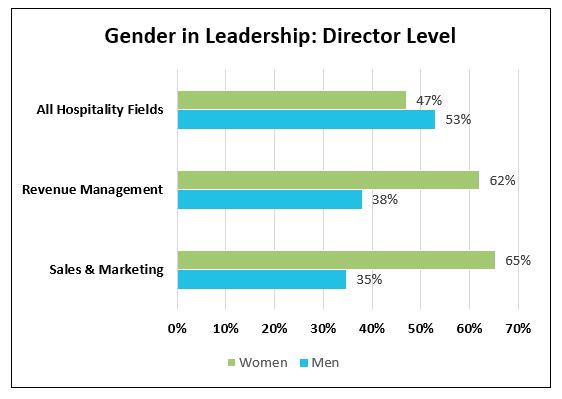

Add in the director level, and the mix skews toward women. This indicates that women soon will become a substantial majority of higher-level roles in these fields:

Add in the director level, and the mix skews toward women. This indicates that women soon will become a substantial majority of higher-level roles in these fields:

Clayton Reid: Well, this shouldn’t be a surprise to our industry, but it’s still the second-highest discretionary spend item for anybody who makes over $50,000 of household income a year. Second, most destinations and economies have put a premium on using travel as a recovery tool for jobs and economic recovery, so there’s a lot of money being put into encouraging travel, both domestically and internationally. And the industry is bringing back supply as quickly as they can to provide the labor to support it, so there’s going to be plenty of opportunities for people to travel again, whereas they maybe didn’t believe that six months ago.

Clayton Reid: Well, this shouldn’t be a surprise to our industry, but it’s still the second-highest discretionary spend item for anybody who makes over $50,000 of household income a year. Second, most destinations and economies have put a premium on using travel as a recovery tool for jobs and economic recovery, so there’s a lot of money being put into encouraging travel, both domestically and internationally. And the industry is bringing back supply as quickly as they can to provide the labor to support it, so there’s going to be plenty of opportunities for people to travel again, whereas they maybe didn’t believe that six months ago. Katie Briscoe: On the softer side, we have some data points and are excited to share those around the fact that consumers’ mindsets have changed. That’s part of the headwind for labor recovery — people have reevaluated how they’re spending their time in their lives and the idea of travel and togetherness is a sought-after experience. And we have to be there to meet that as an industry.

Katie Briscoe: On the softer side, we have some data points and are excited to share those around the fact that consumers’ mindsets have changed. That’s part of the headwind for labor recovery — people have reevaluated how they’re spending their time in their lives and the idea of travel and togetherness is a sought-after experience. And we have to be there to meet that as an industry.

By Robert A. Gilbert, CHME, CHBA, President and CEO, Hospitality Sales & Marketing Association International (HSMAI)

By Robert A. Gilbert, CHME, CHBA, President and CEO, Hospitality Sales & Marketing Association International (HSMAI)

HSMAI recently honored the 2020

HSMAI recently honored the 2020