Insights for HSMAI on comparing Memorial Day and July 4th booking trends as you plan for Labor Day, the last holiday of the summer season.

By: Katie Moro, Vice President, Data Partnerships, Hospitality, Amadeus

As we have heard often in the past few months, we are in unprecedented times, and with that comes new ways to look at things. There is no historical playbook that hoteliers can reference to identify tried-and-true steps to take next for this recovery process. To better understand what hoteliers can do to increase business for the upcoming holiday, we looked at traveler behavior and market performance across a smaller but more relevant period. Are there common patterns, and what can we learn by comparing summer holidays within the context of COVID-19?

Let’s first set the stage. In our July update, we noted the trend of shorter booking lead time (0-7 days) and shifts seen in average daily rates (ADR). We also considered the impact of dropping rate to drive demand, as demonstrated by performance in ten different markets. And, we suggested considering how you’re building your mix of business as this will have an overall impact on profitability and recovery. Keep these factors in mind as you look ahead to the Labor Day holiday, while also considering trends that are evolving from prior summer holidays.

Considering Holiday Trends During COVID-19

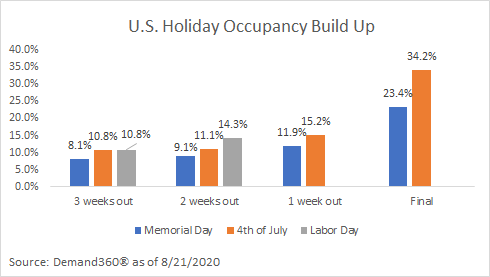

In the following graph, we compare occupancy trends across Memorial Day, July 4th, and Labor Day. We find some consistency in the data. For the first two holidays, there was a gradual increase in occupancy from weeks 3 to 2 to 1. Within one-week before arrival, there was a significant increase in occupancy for both Memorial Day and July 4th.

Labor Day seems to be shaping up similarly. A few travelers are booking their accommodations early. Still, a significant number will likely choose to wait and make last-minute arrangements to travel based on their comfort level at that time. One aspect that does create optimism is the fact that bookings made within one week of arrival had an 11% spike between the Memorial Day to July 4th holidays. This increase may imply that travelers are eager to get out of the house and feeling more comfortable with travel. Based on prior patterns, markets that are seeing any pickup in activity should build a strategy to try to capitalize on the last-minute demand for the last holiday of the summer season.

Occupancy Changes by Market

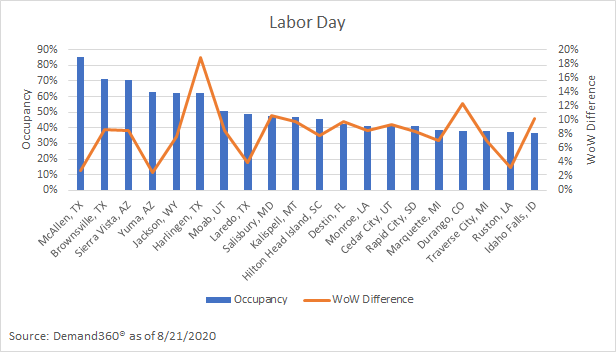

The following graph represents the markets with the highest Labor Day occupancies as of August 21, 2020. In addition to higher occupancies, some of these markets, such as Harlingen, TX and Durango, CO are seeing significant week over week (WoW) growth as we approach the Labor Day holiday. Even with these currently high numbers, trends suggest more reservations are likely to be made as we approach 0-3 day lead time.

Several of the top-performing markets we’re tracking for Labor Day have been in our Top 20 list over the Memorial Day and July 4th holidays. Markets such as Destin, FL and Cedar City, UT have an excellent opportunity to capitalize on this consistent demand to drive revenue over the last summer holiday.

On our “markets to watch” list, Jacksonville, NC, along with Cheyenne, WY, and Jackson, TN, were in the Top 20 for Memorial Day and July 4th. If booking patterns continue down the same path, they have a great opportunity to end in the Top 20 again.

If your market is not on this list, we suggest aligning your sales and marketing initiatives to promote a compelling offering for the holiday weekend. Given the very short booking window, there is still an opportunity to entice travelers to book at your hotel. Craft dynamic messaging and stunning visuals to attract local repeat guests. Highlight your family-friendly suites and activities to appeal to those who may be looking for an end of summer outing before the kids return to school.

It is essential during this upcoming holiday, with increased bookings into Vacation Rentals, to ensure that you can provide accommodations that fit the traveler need. Some ideas could be guaranteeing connecting rooms, offering specialty suites that compete with alternative accommodation pricing, and amenities that cater to family-friendly budgets (i.e. free breakfast).

Since traveler trends are showing so many last minute reservations, we will post updates on LinkedIn to keep you informed of market progress. Follow us for the latest insight.

For additional insights and recommendations for your recovery planning efforts, the teams at Amadeus and HSMAI have collaborated to bring you industry-leading best practices to consider when building, implementing, and monitoring your recovery strategy. As always, we’re here to help. Working together as an industry, we will recover and come back stronger than ever.