According to the latest Longwoods International tracking study of American travelers, the amount they expect to spend on their holiday travel is declining. “Rising prices and interest rates have created financial uncertainty for many consumers,” said Amir Eylon, President and CEO of Longwoods International, who provides exclusive insights on the findings for HSMAI:

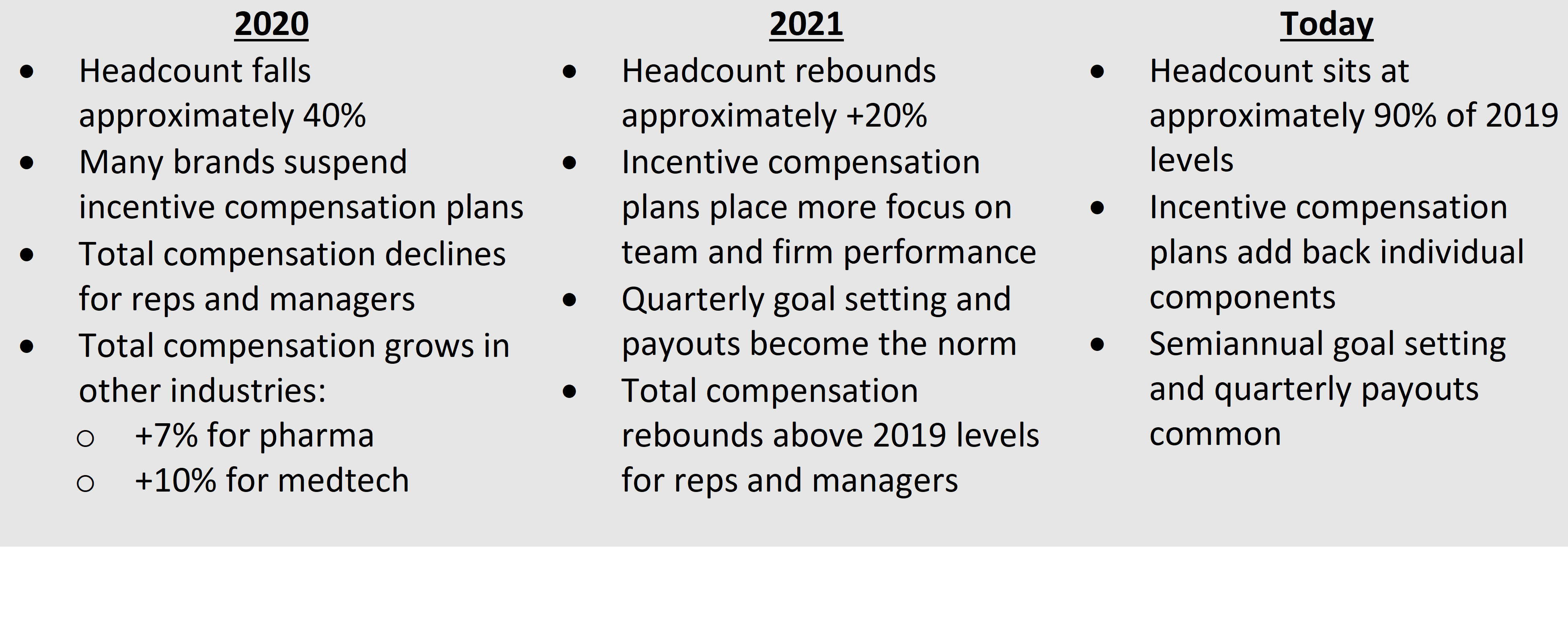

While we see a major rebound in incentive compensation in 2022, significant issues and challenges remain for hospitality brands, including:

While we see a major rebound in incentive compensation in 2022, significant issues and challenges remain for hospitality brands, including:

HSMAI recently honored the 2021

HSMAI recently honored the 2021